If you are looking for a way to improve your student's borrowing habits, then My Smart Borrowing is a great resource. This website contains a number of resources, including five tips about smart borrowing. Once you've signed up, you are able to browse and discuss the information. Set a pace for your students and ask them to complete a graphic organizer to help them understand the site.

iGrad

iGrad is an online tool that helps you manage your student loan debt and learn financial literacy. It helps you to create a budget, and only borrow what you need. In addition, the program offers money management tips, including a student loan snapshot tool, that lets you track all your federal student loan debt. The platform features videos that show students how to borrow smartly, and how to prepare for repayment. iGrad also submits loan data to National Student Loan Data System. It can be accessed and viewed by approved agencies and lenders.

Financial wellness hub

Financial wellness is a key component of college education. You can benefit from this program, whether you are a first-generation student, a member a minority group, or a wealthy student. This free website provides information and resources to assist you in your journey to financial well-being.

Website for college and career planning

My smart borrowing is a career and college-planning website that offers practical advice on college borrowing. Its College Cost Calculator allows you to compare four college options and project your future financial outlook. This website is designed for current college students and recent graduates who are looking to borrow for college.

Smart borrowing with iGrad

iGrad is a student loan repayment platform that offers digital resources and financial education to help students manage student loans. This site also provides an interactive student loan tracking system. This tool will allow students to find out how much money each month they will have left after graduation. U.S. News and World Report reports that many fintech companies are helping students repay student loans.

iGrad has a tool to cancel loans

How to manage money is one the most important skills college students can learn. Using iGrad’s tool to cancel loans is a quick way to ensure you don’t accumulate too much debt upon graduation. This tool will allow you to view all of your loans in one location. You can also talk to a Student Repayment Advisor to find the best way you can manage your finances.

Understanding loan repayment

Focus group participants found it difficult for students to repay student loans. There were many issues with their debt repayments, including delays and missed payments. They also experienced a lack of immediate and sustained relief from their financial difficulties. These borrowers had to make tough tradeoffs to pay their bills on time. These individuals ended up using short-term strategies such as deferment or forbearances.

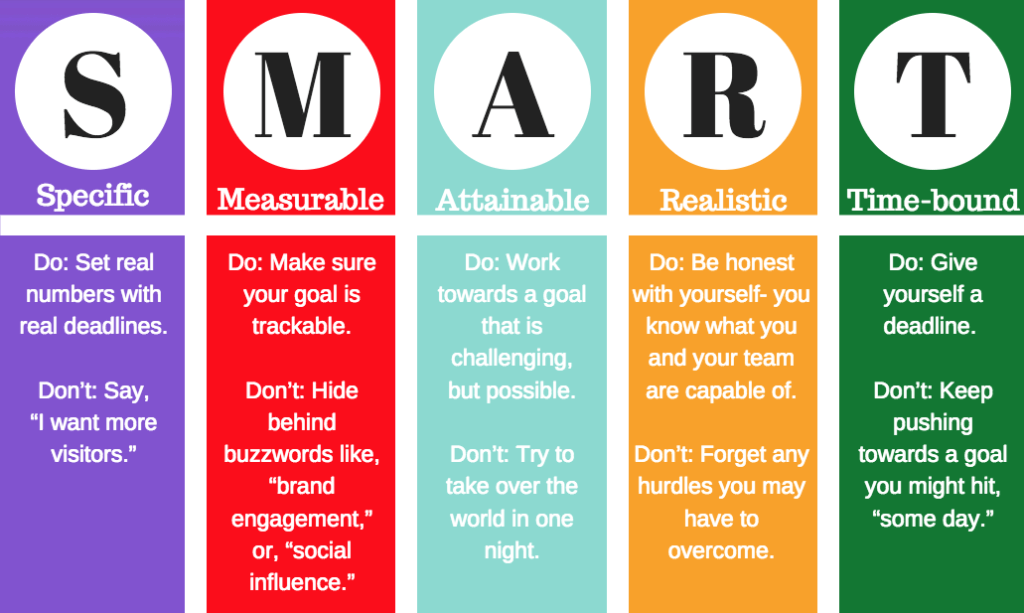

Smart borrowing graphic organizer by iGrad

Smart borrowing can be a valuable skill for any college student. The iGrad financial health hub can help students make smart decisions about student loans borrowing. The website has a lot of information, including videos, infographics, and articles on a range of topics. The topics covered include investing, student loans, career development, and investing. iGrad also offers financial calculators that allow users to monitor their financial status in real-time.